KEY MARKET INSIGHTS

The global wires and cables market size was estimated at USD 202.05 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Rising urbanization and growing infrastructure worldwide are some of the major factors driving the market. The said factors have impacted the power and energy demand in commercial, industrial, and residential sectors. Increased investments in smart upgrading the power transmission and distribution systems and development of smart grids are anticipated to drive the market’s growth. Implementation of smart grid technology has met the increasing need for grid interconnections, thus resulting in rising investments in the new underground and submarine cables.

Increased energy demands in the Asia Pacific, Middle East, and South America have resulted in rising investments in smart grids in the regions. This will fuel the demand for low-voltage cables. The other factors that influence the growth of low voltage cables are the growth in the power generation, power distribution sector from renewable energy sources, and demand from automotive and non-automotive industries. Urbanization and industrialization are the major reasons for increasing overall market growth. The need for power grid interconnections in areas with dense population are creating a demand for underground and submarine cables. Regions such as North America and Europe are switching towards the adoption of underground cables instead of overhead cables. The underground cables reduce space required and offers reliable transmission of electricity.

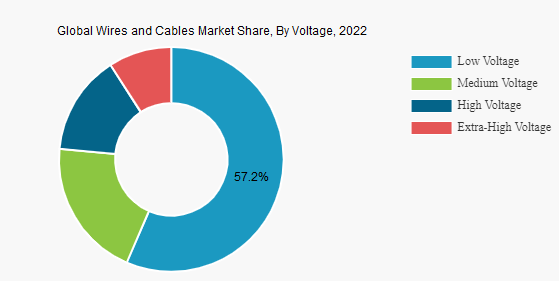

By Voltage Analysis

The market is segmented into low, medium, high, and extra-high voltage based on voltage. The low voltage segmentdominates the wires and cables market share owing to the wide application of low voltage wires & cables innfrastructures, automation, ighting, sound and security, and video surveilance, among other applications.

The medium voltage segment is projected to hold the second-largest share due to the increasing application in mobilesubstation equipment,commercial buildings, hospitals, and universities & institutions. Medium voltage wires andcables are widely used for power distribution between high voltage mains power supply and low voltage applicationsand utility companies to connect residential and industrial complexes, or renewable energy sources such as wind andsolar farms, to the primary grid.

The high voltage segment also increases its market share due to growing government initiatives for expanding thegrid. lt is preferable for power transmission & distribution purposes from utilities and commercial applications. Extrahigh voltage cable is mostly used in power transmission utilities and many other industries, including water, airportsrailways, steel, renewable energy, nuclear and thermal power stations, and other manufacturing industries.

Increased energy demands in the Asia Pacific, Middle East, and South America have resulted in rising investments in smart grids in the regions. This will fuel the demand for low-voltage cables. The other factors that influence the growth of low voltage cables are the growth in the power generation, power distribution sector from renewable energy sources, and demand from automotive and non-automotive industries. Urbanization and industrialization are the major reasons for increasing overall market growth. The need for power grid interconnections in areas with dense population are creating a demand for underground and submarine cables. Regions such as North America and Europe are switching towards the adoption of underground cables instead of overhead cables. The underground cables reduce space required and offers reliable transmission of electricity.

Low Voltage Cable Market Trends

Underground Low Voltage Cable to be the Fastest Growing Market

- Deployment of underground cables instead of overhead ones has been one of the trends in regions, like Europe and North America, in the recent times. In urban areas, underground cables are more favored, as above-ground space is not available.

- Underground cables are also more reliable due to the lesser number of annual faults, compared to overhead ones. Despite the higher expenses in underground cables, utilities are now investing more in underground cables, and are encouraged by regulators in developing regions such as Asia-Pacific and Africa.

- In recent years, across Europe, specifically Germany and Netherlands, there is an increasing trend to replace the existing overhead distribution lines with underground cabling and give preference to underground cabling for new projects. Moreover, India is also witnessing increasing adoption of underground cables. Among the 100 smart city projects of the country, several projects include underground cables.

- Vietnam is also replacing the power cables from overhead to underground in two of its major cities, HCMC and Hanoi. Besides deploying underground cables in major roads, the exercise has also been extended to passages within the cities. The overhead cable replacements are expected to take place between 2020 and 2025, in turn, driving the market for underground cables.

Asia-Pacific to Dominate the Market

- Asia-Pacific has emerged as one of the major low voltage cable markets in the recent years. The rise in energy demand associated with urbanization, economic modernization, and better living standards across the region has resulted in the growth of sustainable power systems, which in turn increased the demand for low voltage cable market in this region.

- Asia-Pacific’s increasing investments in T&D networks and smart grid infrastructure is expected to increase the demand for low voltage cables. Countries such as China, Japan, and India are expected to be the fastest growing markets owing to their energy transition and smart grid infrastructure plans.

- In India, residential building construction is expected to witness significant growth in the near future, supported by the government’s Housing For All plan and the Pradhan Mantri Awas Yojana (PMAY), slated to be completed by 2020. Under PMAY, the government is expected to build 60 million houses (40 million in rural areas and 20 million in cities) by 2022.

- China has installed nearly half of all new capacity in 2018 and continues to lead the global capacity additions in solar and wind. Increasing installation capacities of solar and wind energy in this region are expected to boost the demand for low voltage cables during the forecast period.

Post time: Jun-19-2023